Sep 1, 2024

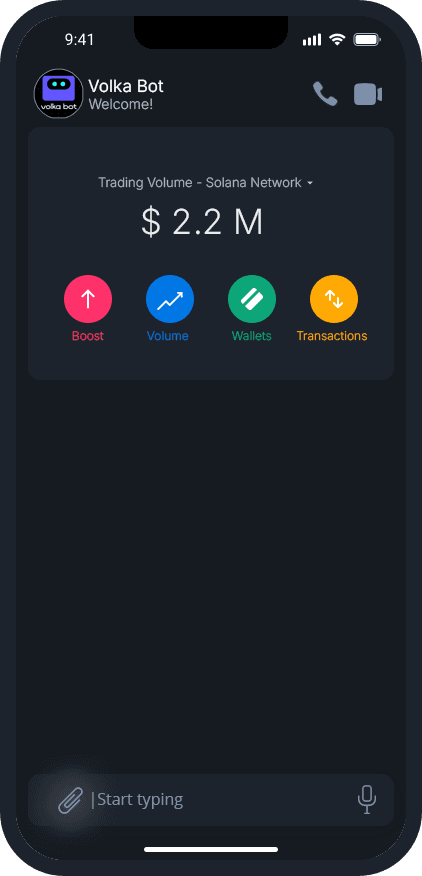

Unlocking the Benefits of Trading Volume on Solana: How It Enhances Your Trading Experience

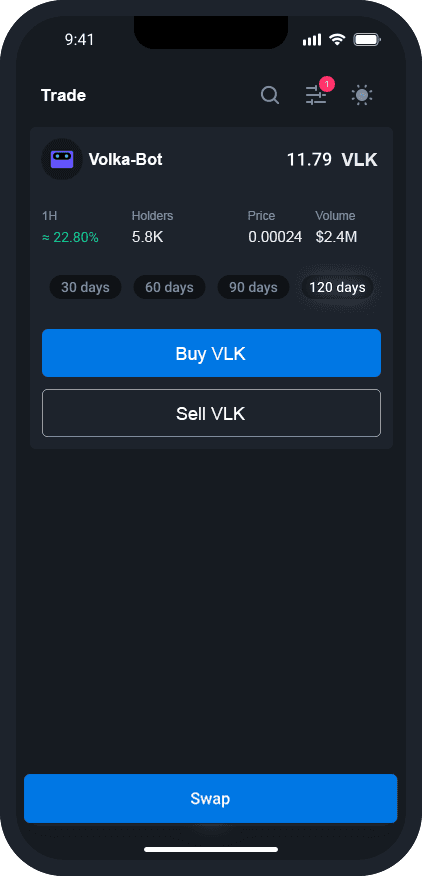

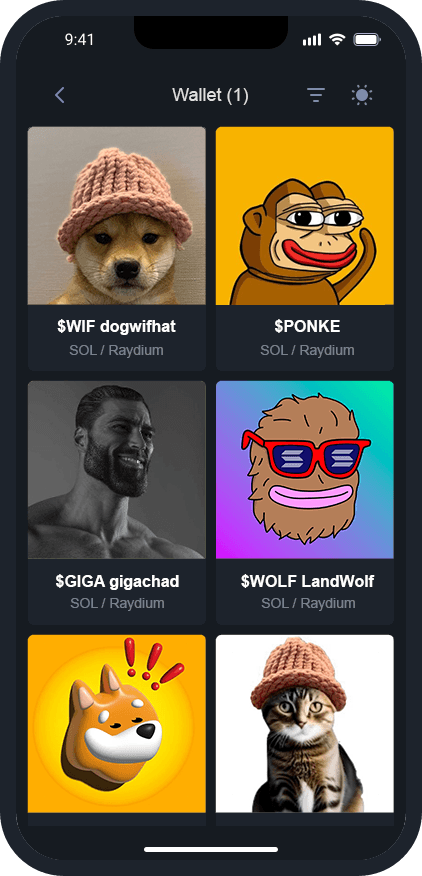

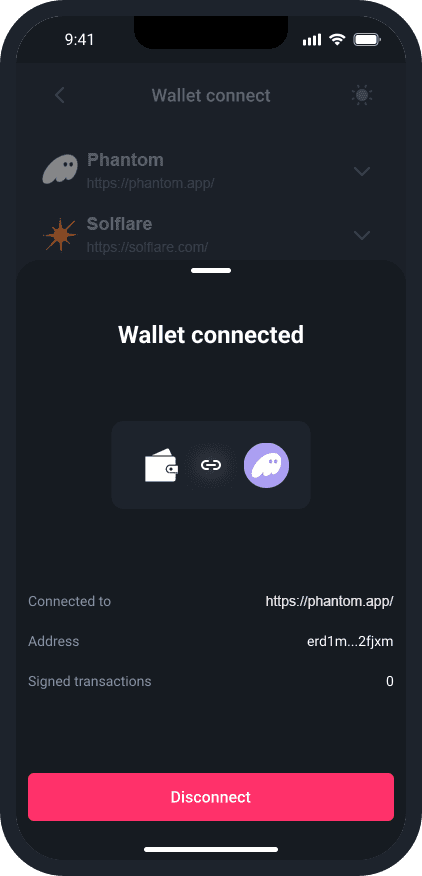

Expand Your Solana Experience: Learn How to Effortlessly Trade Solana Meme Coins on Your Solana Network

Introduction

Trading volume is a key metric in the world of cryptocurrency trading, and on the Solana blockchain, its benefits are particularly pronounced. With Solana’s rapid transaction speeds and low fees, understanding and utilizing trading volume can significantly enhance your trading strategies and outcomes. This blog explores the numerous advantages of trading volume on Solana, highlighting how it can help you make informed decisions, optimize your trades, and ultimately achieve better results in the fast-paced crypto market.

1. Improved Market Liquidity

Benefit: Enhanced Liquidity

Explanation: High trading volume on Solana indicates greater market liquidity, which means you can buy or sell tokens more easily without significantly affecting their price. This is crucial for executing large trades and reducing slippage—the difference between the expected price and the actual price of a trade. Solana’s efficient network ensures that high-volume trading can be conducted with minimal fees and delays.

2. Better Price Discovery

Benefit: Accurate Price Determination

Explanation: Trading volume plays a vital role in price discovery—the process of determining the fair value of a token based on supply and demand. High trading volume provides a more accurate reflection of a token’s market value, helping traders make informed decisions. On Solana, where transactions are processed quickly and cost-effectively, high trading volume ensures that prices are reflective of current market conditions.

3. Enhanced Trend Confirmation

Benefit: Reliable Trend Analysis

Explanation: Volume is an essential tool for confirming market trends. Rising trading volume during an uptrend or downtrend can validate the strength of that trend, giving traders confidence in their strategies. On Solana, you can easily track volume trends using various analytics tools and decentralized exchanges (DEXs), allowing you to make well-informed trading decisions based on confirmed market movements.

4. Reduced Impact of Market Manipulation

Benefit: Lower Manipulation Risk

Explanation: High trading volume on Solana can help mitigate the impact of market manipulation. With greater liquidity, it becomes more challenging for individuals or groups to manipulate prices through large trades or false signals. This creates a more stable trading environment, where price movements are driven by genuine market activity rather than manipulative practices.

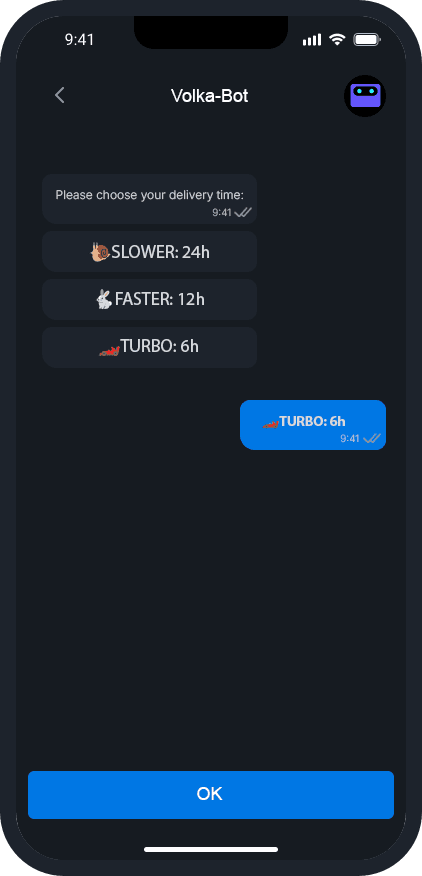

5. Access to Better Trading Opportunities

Benefit: Increased Trade Options

Explanation: On Solana, high trading volume often correlates with a wide range of trading opportunities. As more tokens and projects gain traction, the increased volume can lead to new and diverse trading options. Traders can explore different tokens, participate in emerging projects, and capitalize on various market trends, all facilitated by Solana’s efficient trading infrastructure.

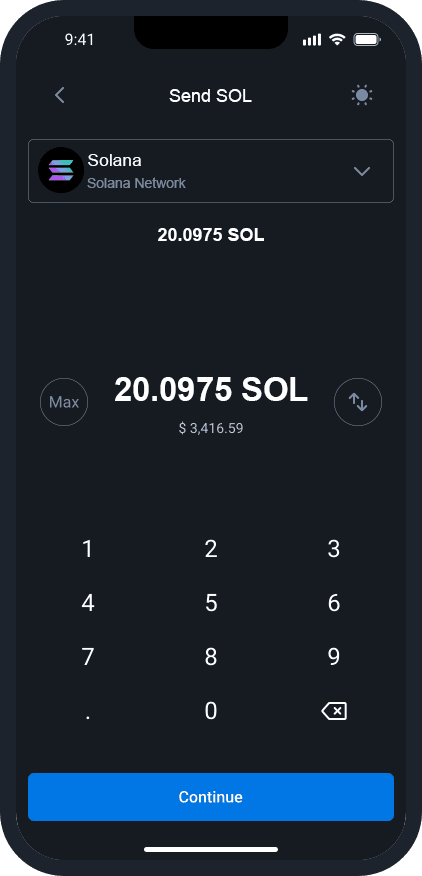

6. Faster Execution and Lower Costs

Benefit: Efficient Trading

Explanation: Solana’s network is known for its rapid transaction speeds and low fees. High trading volume benefits from these features, allowing traders to execute trades quickly and cost-effectively. This is particularly advantageous in a volatile market where timely execution can make a significant difference in trading outcomes.

Conclusion

Trading volume on Solana offers a range of benefits that can enhance your trading experience and strategy. From improving market liquidity and accurate price discovery to confirming trends and reducing manipulation risks, high trading volume provides valuable insights and opportunities. By leveraging these advantages, you can optimize your trading decisions and take full advantage of the dynamic Solana ecosystem. As always, stay informed and adapt your strategies to make the most of the benefits that trading volume offers.