Sep 1, 2024

Harnessing the Power of Trading Volume: A Comprehensive Guide to Trading Volume with Your Solana Wallet

Harnessing the Power of Trading Volume: A Comprehensive Guide to Trading Volume with Your Solana Wallet

Introduction

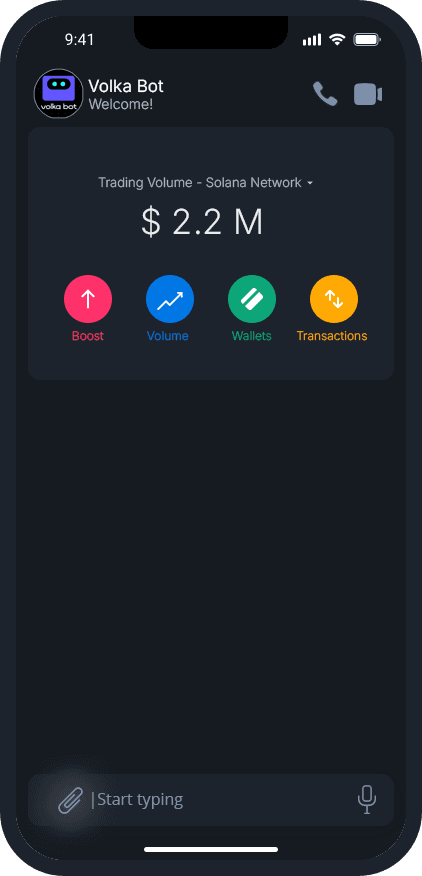

Trading volume is a critical metric in the cryptocurrency world, providing valuable insights into market activity, liquidity, and price trends. For Solana users, understanding and leveraging trading volume can significantly enhance your trading strategies and overall performance. With Solana’s fast and low-cost transactions, your wallet becomes a powerful tool to capitalize on trading volume dynamics. This guide will walk you through the essentials of understanding, tracking, and harnessing trading volume using your Solana wallet, enabling you to make informed decisions and optimize your trading outcomes.

1. Set Up and Fund Your Solana Wallet

Before diving into trading volume strategies, ensure your Solana wallet is ready for action:

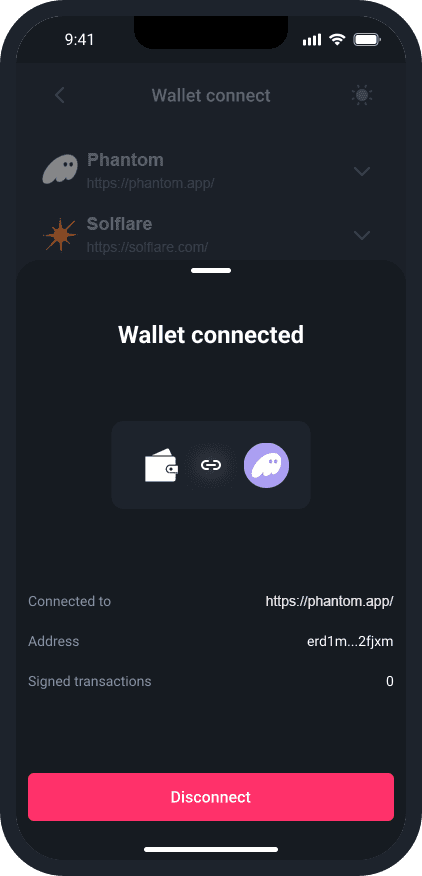

Choose a Wallet: Popular Solana-compatible wallets include Phantom, Solflare, and Sollet. Select one that fits your needs.

Install and Set Up: Download the wallet as a browser extension or mobile app, and create a new wallet. Safeguard your seed phrase as it’s essential for recovery.

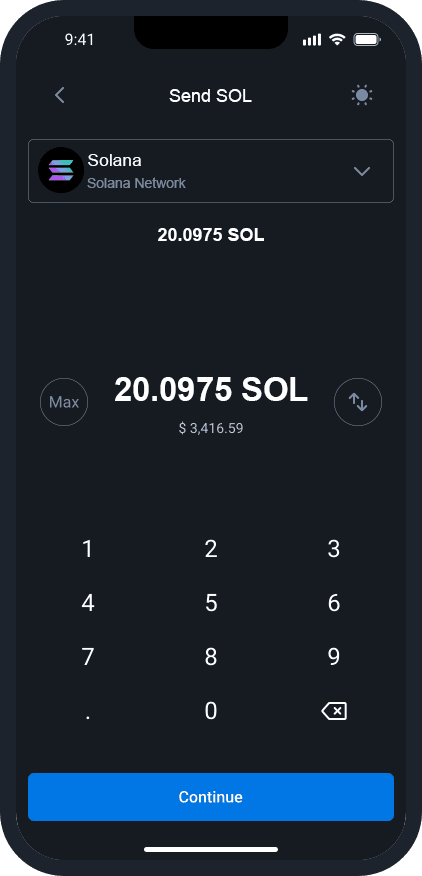

Fund Your Wallet: Deposit SOL into your wallet. SOL will be used for transaction fees and executing trades.

2. Understand Trading Volume

To effectively use trading volume in your strategy, you need to understand what it represents:

Definition: Trading volume refers to the total amount of a cryptocurrency that has been traded within a specific period. It’s a measure of market activity.

Significance: High trading volume typically indicates strong interest and liquidity, while low volume might suggest a lack of momentum or potential price volatility.

Market Sentiment: Volume can signal market sentiment. For instance, increasing volume during a price rise may indicate a strong uptrend, whereas decreasing volume might signal a potential reversal.

3. Develop and Execute Your Trading Strategy

Leverage trading volume to inform your trading decisions:

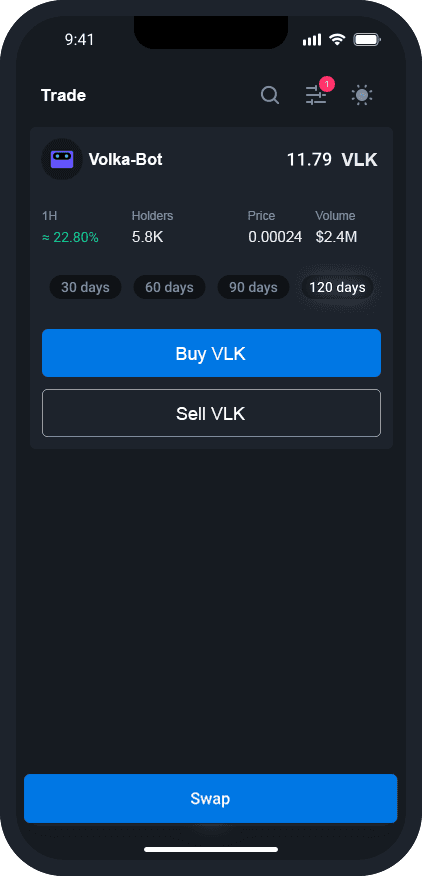

Volume Insights: Use volume data to identify trends and confirm market momentum. Increasing volume often indicates a strong trend.

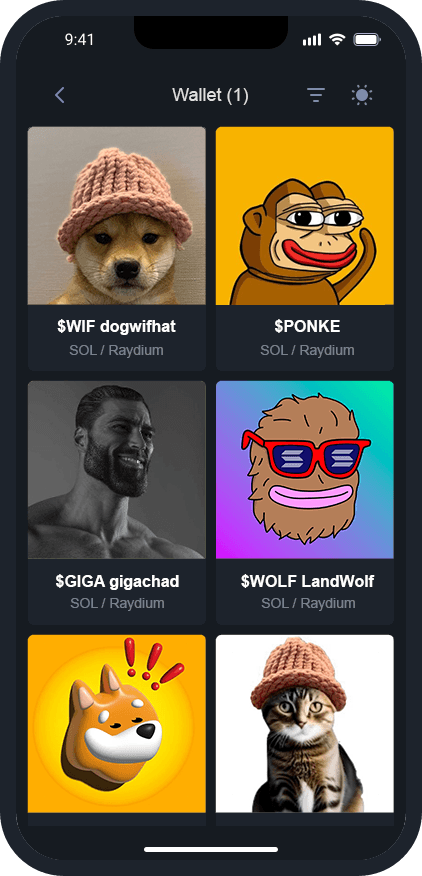

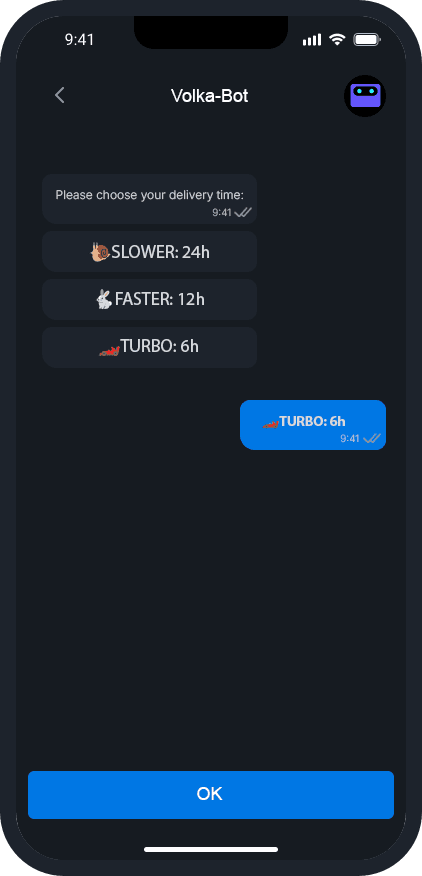

Trade Execution: Connect to a decentralized exchange (DEX) like Raydium via your wallet, analyze the volume data, and execute trades based on your strategy.

4. Develop a Trading Strategy Based on Volume

Trading volume can be a powerful tool in developing your strategy:

Volume-Weighted Average Price (VWAP): Use VWAP to determine the average price of a token based on volume, helping you identify ideal entry or exit points.

Identify Breakouts: Monitor volume spikes to identify potential breakouts or breakdowns, signaling strong buying or selling pressure.

Confirm Trends: Use trading volume to confirm the strength of a trend. For example, increasing volume in an uptrend suggests that the trend is likely to continue.

Conclusion

By following these streamlined steps, you can effectively harness the power of trading volume with your Solana wallet. Understanding and integrating volume insights into your trading strategy allows you to make more informed decisions, helping you navigate the dynamic world of cryptocurrency with greater confidence.

Disclaimer

The information provided in this guide is for educational purposes only and does not constitute financial or investment advice. Trading cryptocurrencies involves risk and may not be suitable for all investors. Always conduct your own research and consider consulting a qualified financial advisor before making any trading decisions. The use of trading volume data and strategies should be done with caution, and you should be aware that market conditions can change rapidly. Your investments and trading activities are your own responsibility.